By James Rich, Managing Partner & Co-Founder

As electricity demand rises and renewable supply scales, a surge of investment opportunities is emerging across the technologies powering the next-generation energy system.

Executive Summary

The U.S. electricity sector is undergoing an historic transformation, driven by surging demand and a sweeping shift toward renewable energy. Key demand drivers include Al data centers, electric vehicles, climate adaptation technologies, and electrification of buildings. Simultaneously, the supply side is evolving rapidly, with renewables accounting for over 90% of new capacity additions in 2025.

To meet projected demand growth-up to 78% by 2050- the U.S. must double its annual capacity additions to 80 GW/year1. According to BloombergNEF, to align with a net-zero pathway, global energy transition investment needs to reach $2.5-3.4 trillion annually by 20302.

Private credit is increasingly recognized as an engine for financing the renewable energy, distributed energy resources, and grid modernization. According to Goldman Sachs Asset Management, while private equity has historically dominated energy transition capital flows, the next phase of growth will be driven by credit3. This is due to the maturation of clean energy technologies, which now offer more stable cash flows and lower risk profiles, making them good candidates for debt financing.

Growing Demand & Supply

The demand for electricity in the U.S. is on a steep upward trajectory after a decade of flat usage. The rapid growth of data centers to support Al technology, the electrification of transportation from electric vehicles, the increasing prevalence of heat pumps, and the rising use of air conditioners due to climate change are all contributing to this demand growth. Experts suggest that U.S. electricity demand is expected to grow by as much as 25% by 2030 and by 78% by 2050, compared to 20234.

The U.S. power sector is in the midst of a transformation, retiring older plants while rapidly building new ones, especially renewables. To meet even moderate demand growth, the pace of capacity additions will need to accelerate. According to an analysis by ICF, the U.S. will need to add on the order of 80 GW of new generating capacity every year from 2025 through 2045 to satisfy rising demand and replace retiring units5. That is roughly double the recent rate of additions, which averaged ~40 GW/year over 2018-20226. In other words, an immense build-out is required – on par with constructing dozens of new power plants or hundreds of wind/solar farms each year. This 80 GW/year figure encompasses all generation types and assumes an “all-of-the-above” mindset, including renewables, gas, nuclear, and storage.

The Role of Renewable Energy

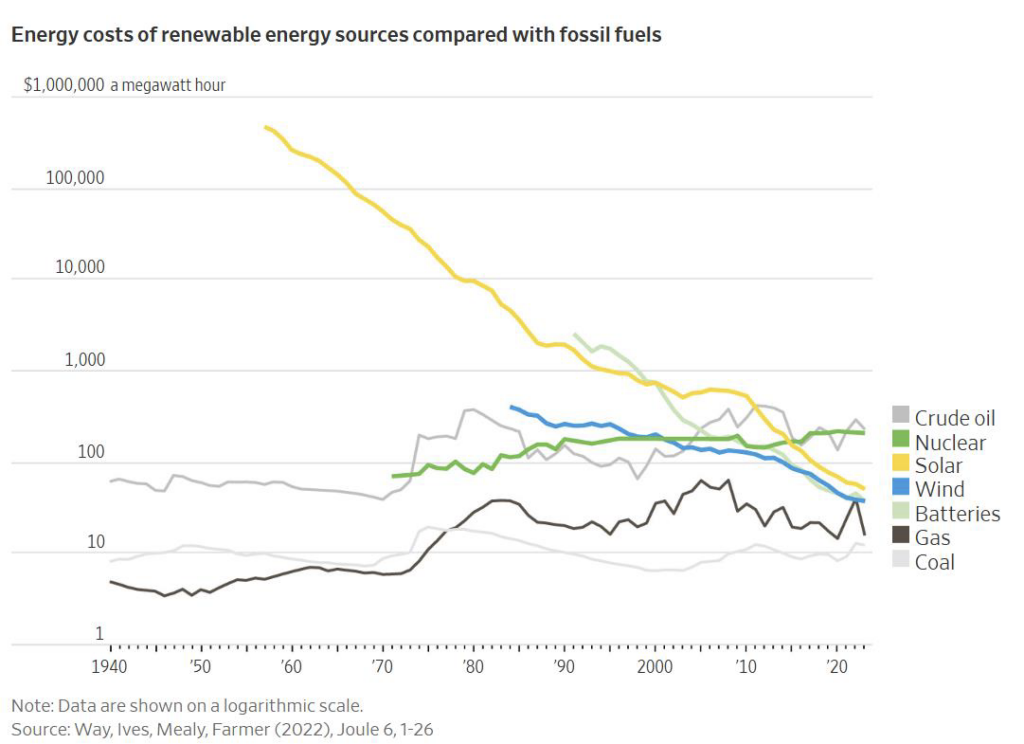

Renewable energy in the US comprised approximately 24% of total U.S. utility-scale electricity generation in 2025 and continues to grow7. Even if policy support from policies like the Inflation Reduction Act is removed entirely, renewable energy remains among the cheapest forms of electricity generation and significant amounts of renewable energy will still need to be built. The cost of renewable energy and other climate technologies has and continues to decrease significantly, making them competitive even without government subsidies.

In 2025, 93% of new power generation capacity being installed in the U.S. is from renewables, including solar, battery storage, and wind8, illustrating the strong demand for renewable energy due to its advantages over legacy energy sources. Renewable energy continues to improve in efficacy and become cheaper, while fossil fuels become harder to extract with every barrel produced and ultimately less competitive in the long run.

Investment Opportunities

The transition to a sustainable energy system is not just about building solar farms and wind turbines, but also about innovating all the “glue” technologies that allow a myriad of small resources to work together. Numerous products and services will be needed to support the growth in supply of renewable and other energy sources, presenting over $3.4 trillion of investment opportunity. Distributed energy technologies are emerging as some of the most attractive investment opportunities in the renewable energy sector. These technologies – ranging from virtual power plants (VPPs) to microgrids, battery storage systems, demand response and energy efficiency systems, and intelligent grid monitoring devices – play critical roles across the renewable energy value chain. Unlike utility-scale wind farms or solar parks, these are typically modular solutions that enhance grid resilience, improve energy security, and capitalize on technological advancements to reduce costs.

| Category | Estimated Global Market Size | Key Drivers |

|---|---|---|

| All Distributed Energy Resources (DERs) | ~$850 billion (cumulative 2020-2030)9 | Declining solar & battery costs; demand for resiliency |

| Virtual Power Plants (VPPs) | ~$14 billion (annual market by ~2030)10 | Need for grid flexibility; software advances; DER aggregation value |

| Microgrids | ~$80 billion (annual market by 2030)11 | Reliability & resilience; extreme weather mitigation; renewable integration |

| Battery Energy Storage Systems (BESS) | ~$300 billion (cumulative 2020-2030)12 | Hardware cost declines; capacity market revenues; balancing renewables variability |

| Grid Monitoring & Management (Smart Grid) | ~$173 billion (annual market by 2030)13 | Modernizing aging grids; accommodating EVs/DERs; preventing outages |

| Demand Response & Smart Home Energy Management | ~$70-85 billion (annual market by 2030, est.) | Peak demand charge avoidance; smart devices (loT) proliferation; utility DR programs |

| Energy Efficiency & Electrification | ~$1.9 trillion per year (by 2030, global net-zero pathway)14 | Fuel cost savings; efficiency gains |

Distributed Energy Resources (DERs)

DERs – such as rooftop solar, small wind, and home battery systems – are proliferating rapidly and poised to add enormous capacity in the coming years. In the U.S., DER deployment is expected to grow by about 262 GW from 2023 to 2027, nearly matching the 271 GW of new utility-scale generation planned in that period15. This explosive growth means that by 2027 DERs will contribute almost as much new capacity as centralized power plants, highlighting a major shift toward decentralized energy. DERs can strain local grid stability and be hard for utilities to control if deployed without coordination, but smart inverters, grid management systems, and aggregated control (like through virtual power plants) can help mitigate integration issues by smoothing output.

Virtual Power Plants (VPPs)

Virtual Power Plants are a high-growth opportunity transforming how DER capacity is utilized for grid reliability and market value by aggregating distributed resources via software. A VPP is a “cloud-based” power plant that connects numerous distributed assets (solar panels, batteries, smart thermostats, EV chargers, etc.) and coordinates their output or demand reduction as a unified resource. By pooling these resources, VPPs can provide services traditionally offered by large power plants – such as peaking power, frequency regulation, and reserve capacity – without building new generation. Indeed, the global VPP market is projected to explode from $1.4 billion in 2023 to around $24 billion by 203216, 1 a 38% annual growth rate, reflecting both the proliferation of DER assets and the expanding software/platform capabilities to aggregate them. VPPs depend on many distributed assets performing in concert, so a key risk is reliability – a communication failure or non-responsive participant could cause the aggregate to under-deliver on power commitment. However, this is offset by robust control software, redundant assets in the portfolio, and regulatory frameworks that ensure VPPs have backup plans and verification in place.

Microgrids

Microgrids – localized energy networks that can operate independently – are gaining traction as a resilient, flexible solution, particularly in response to extreme weather and reliability needs. A microgrid is a mini electric grid serving a campus, community, or facility, with its generation (solar PV, wind, or diesel gensets) and energy storage, capable of disconnecting from the main grid during disruptions. Interest in microgrids is expanding in the U.S.: as of 2022, there were over 575 microgrids operational nationwide, with ~ 7 GW of capacity17. The total U.S. microgrid capacity is expected to more than quadruple to about 32.5 GW by 203018, ‘ reflecting efforts by critical facilities (hospitals, military bases, data centers), municipalities, and businesses to ensure energy continuity and resiliency. Microgrids face high upfront costs and each project is often custom-designed, making financing and standardization a challenge. However, using modular designs can reduce engineering complexity and financing risks, and new business models (e.g. microgrids-as-a-service) are emerging to spread costs and streamline regulatory approvals.

Battery Energy Storage Systems (BESS)

BESS is a cornerstone technology that enables renewable energy integration and grid resilience, with a rapidly expanding market and improving economics. Batteries provide the critical ability to store excess energy and deliver it on demand, which smooths out the intermittency of solar and wind power and improves energy reliability. In recent years, deployment of battery storage has accelerated dramatically. In the U.S., large-scale battery installations reached approximately 22,385 MWh in 2022, an 80% jump from 2021. This momentum is continuing, with multiple gigawatt-scale projects underway. North America’s battery storage market is projected to reach $17.3 billion in 2025, growing to $34.5 billion by 2030 (nearly doubling in five years)19. The cost profile of battery storage has improved as well. Lithium- ion battery packs have seen a ~88-89% cost decline over the last decade20 and are expected to continue decreasing in the long term. Manufacturers are innovating with new chemistries like sodium-ion, solid- state, and flow batteries that promise either lower costs or longer durations, opening new markets (e.g., replacing diesel gensets or providing multi-day backup). Also, large manufacturing investments. (gigafactories being built worldwide) will increase supply and potentially lower unit costs further. Utility- scale batteries carry safety risks (e.g. thermal fires) and can suffer faster-than-expected degradation under heavy use, but these issues are mitigated by stringent safety standards (e.g. fire suppression, battery management software) and continuously improving battery chemistries. Additionally, warranties from battery OEMs help ensure investors are protected against early failures.

Grid Monitors and Management Systems (Smart Grid)

Intelligent grid monitoring systems, including advanced sensors, smart meters, and automated controls, are crucial for modernizing the grid and improving resilience against extreme weather events. These technologies encompass a range of hardware and software: Advanced Metering Infrastructure (AMI) with smart meters at customer premises, line sensors and fault detectors on distribution feeders, Phase Measurement Units (PMUs) on transmission lines, weather monitoring integration, and overarching control software like Advanced Distribution Management Systems (ADMS) or Distributed Energy Resource Management Systems (DERMS). Together, they provide a high-resolution, real-time picture of grid conditions and often the ability to automatically respond to problems (a concept known as “self- healing” grids). From an economic standpoint, these technologies can save utilities money by reducing outage costs (avoiding regulatory penalties, compensation payouts, and overtime repair costs) and optimizing operations (reducing losses, balancing loads better). For instance, the financial analysis in California of smart inverter rollout (one part of grid intelligence) projected hundreds of millions in savings per year21. Connecting grid infrastructure to networks introduces cybersecurity and reliability risks, but utilities mitigate this by implementing multi-layer cybersecurity defenses, fail-safe mechanisms, and rigorous testing of automation systems. Moreover, maintaining the ability for manual override and backup power management procedures provides insurance against tech failures.

Demand Response & Smart Home Energy Management Demand response (DR) programs and smart home energy management technologies reduce and shift electricity consumption at peak times, offering cost savings and grid balance with minimal capital investment. Instead of increasing supply, DR curtails or shifts demand to match supply – a crucial strategy when integrating renewables or avoiding overloads. Products like smart thermostats, smart appliances, and automated control systems enable residential and commercial consumers to participate in DR seamlessly. For instance, utilities can signal a fleet of smart thermostats to adjust by a few degrees during a peak hour, trimming the overall demand spike. In aggregate, this can free up huge amounts of capacity; millions of small adjustments add up to many megawatts (or even gigawatts) of reduced load. These programs risk inconsistent user participation, but strong incentives from utilities, municipalities and states and user education can increase participation rates. Further, automated demand response solutions (e.g. smart thermostats that adjust usage automatically) also ensure reliable performance while minimizing inconvenience to consumers.

Energy Efficiency

Energy efficiency upgrades complement renewable energy by reducing overall demand, resulting in cost savings and strengthened energy independence. While efficiency isn’t a power source, it is often termed the “first fuel” because the cheapest and cleanest kilowatt-hour is the one not used. Emerging efficient technologies and retrofits like heat pumps for heating/cooling, LED lighting, and improved building insulation dramatically cut energy waste. Major efficiency retrofits at the commercial and industrial scale can be slowed by high upfront costs, but this can be mitigated by innovative and flexible financing structures that blend elements of credit and equity.

Conclusion

From an investment perspective, these technologies and services are not only individually attractive but collectively form an ecosystem of solutions for a clean, reliable, and resilient energy future. The rationale behind their attractiveness includes quantifiable benefits (e.g., sizable market size growth, favorable economics) and qualitative strengths (risk mitigation). By investing in this spectrum of innovations, investors can capture value at different points in the renewable energy value chain – generation, storage, distribution, and end-use. Private credit is emerging as the key driver of clean energy financing, thanks to the maturity of renewable technologies that now support debt investments.Finally, it’s noteworthy that these opportunities are interdependent and often mutually reinforcing. As renewable generation shifts to a decentralized model, the grid requires more intelligence and storage; as extreme weather threatens the grid, microgrids and VPPs step in. Therefore, a holistic approach that leverages multiple of these avenues can yield compounding benefits.

- ICF, Rising current: America’s growing electricity demand, accessed June 18, 2025, https://www.icf.com/insights/energy/impact-rapid-demand-growth-us. ↩︎

- World Economic Forum, Fostering Effective Energy Transition 2025: Insight Report, June 2025. Represents estimates from major energy outlooks like those from the IEA and BloombergNEF of $5.6 trillion annual investment needed by 2030 excluding solar projects, wind projects, and energy storage projects. ↩︎

- ICF, Rising current: America’s growing electricity demand, accessed June 18, 2025, https://www.icf.com/insights/energy/impact-rapid-demand-growth-us. ↩︎

- ICF, Rising current: America’s growing electricity demand, accessed June 18, 2025, https://www.icf.com/insights/energy/impact-rapid-demand-growth-us. ↩︎

- Ibid. ↩︎

- Ibid. ↩︎

- BloombergNEF, Sustainable Energy in America: 2025 Factbook, Tracking Market & Policy Trends. ↩︎

- U.S. Energy Information Administration, In-Brief Analysis, February 2025. ↩︎

- Frost & Sullivan, Nearly $1 Trillion in Investments Estimated by 2030 as Power Sector Transitions to a More Decarbonized and Flexible System, accessed June 18, 2025, https://www.frost.com/news/press- releases/energy-environment-press-releases/nearly-1-trillion-in-investments-estimated-by-2030-as-power~ sector-transitions-to-a-more-decarbonized-and-flexible-system/ ↩︎

- Spherical Insights, Global Virtual Power Plant Market Size To Worth USD 13.65 Billion By 2032 | CAGR Of 22.3%, accessed June 18, 2025, https://finance.yahoo.com/news/global-virtual-power-plant-market- 110000018.html?guccounter=1&guce_referrer=aHROcHM6Ly9tMzY1LmNsb3VkLm1pY3Jvc29mdC8&guce_refe rrer_sig=AQAAA|I8C3Zzk7-LhgKBMGg-NTIZaiF8- KdbMDjm3CXfOTivBM802|gcx0i2|kmpYtzqenxus72LIpWXVVkKBx5KkeDqjAXZnJ64c3T5r- meXCyrMFLUND44p0J605yRYOV6120mE-4jOZJTLopoBgljsPrC3yTPS7CTITxlyDbrPWqx. ↩︎

- Verified Market Research, Microgrid Market size worth $ 82.55 Billion, Globally, by 2030 at 11.98% CAR, accessed June 18, 2025, https://finance.yahoo.com/news/microgrid-market-size-worth-82-151500295.html ↩︎

- Frost & Sullivan, Nearly $1 Trillion in Investments Estimated by 2030 as Power Sector Transitions to a More Decarbonized and Flexible System, accessed June 18, 2025, https://www.frost.com/news/press- releases/energy-environment-press-releases/nearly-1-trillion-in-investments-estimated-by-2030-as-power- sector-transitions-to-a-more-decarbonized-and-flexible-system/ ↩︎

- Research and Markets, Smart Grid Market Report 2025-2030, January 2025. ↩︎

- International Energy Agency, Energy Efficiency 2024, November 2024. ↩︎

- US Department of Energy, 2024 Smart Grid System Report, February 2024. ↩︎

- Fortune Business Insights, Virtual Power Plant Market Size, Share & Industry Analysis, By Technology (Demand Response, Distributed Generation, and Mixed Asset), and by End-user (Industrial, Commercial, and Residential), and Regional Forecast, 2024-2032, accessed June 18, 2025, https://www.fortunebusinessinsights.com/industry-reports/virtual-power-plant-market-101669 ↩︎

- National Renewable Energy Laboratory, Summary of Microgrid Activities in the USA, accessed June 18, 2025, https://www.microgrid-symposiums.org/wp-content/uploads/2023/09/7.1.-US-and-Canada-Overview.pdf. ↩︎

- Ibid. ↩︎

- Mordor Intelligence, North America Battery Energy Storage System Market – Growth, Trends, and Forecasts (2024-2029), accessed June 18, 2025, https://www.mordorintelligence.com/industry-reports/north-america- battery-energy-storage-system-market. ↩︎

- Bloomberg NEF ↩︎

- California Energy Commission, Smart Inverter Interoperability Standards and Open Testing Framework to Support High-Penetration Distributed Photovoltaics and Storage, August 2020. ↩︎