By James Rich, Managing Partner & Co-Founder

As rising energy prices and new technologies reshape the built environment, scalable solutions that boost building energy efficiency are emerging as compelling investment opportunities.

Executive Summary

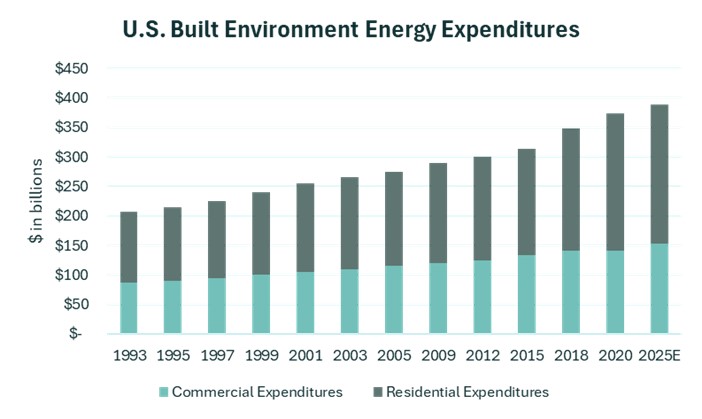

The built environment – encompassing our homes, offices, and commercial/industrial facilities – is a cornerstone of energy consumption. In the United States, buildings account for roughly 40% of primary energy use, including 74% of electricity use, and 35% of carbon emissions[i]. This significant energy footprint means that improving building efficiency as global energy costs rise is a huge opportunity. Strengthening resource efficiency in buildings by reducing energy demand lowers operating costs.

Source: U.S. Energy Information Administration. Commercial Buildings Energy Consumption Survey (CBECS)[ii] and Residential Energy Consumption Survey (RECS)[iii]. Some data was extrapolated; see endnotes for explanations and important disclosures.

Macro trends are accelerating investment in energy-saving technologies. Solutions supporting the built environment sector are experiencing growth fueled by urbanization, stricter building codes and sustainability regulations, and rising energy costs. Governments and businesses are pursuing aggressive energy efficiency targets, driving demand for innovative solutions that can cut energy usage. At the same time, technological advancements (e.g. in sensors, materials, and heat pump technology) and economies of scale are bringing down costs, making these solutions more economically attractive for businesses and investors alike. The result is a robust pipeline of investment opportunities in building-related technologies that improve resource efficiency and reduce energy needs.

Private credit is also increasingly recognized as a tool for financing companies that enhance building efficiency. Whereas equity investors struggle to fund capital-intensive solutions, private credit offers flexibility and speed to fill the gap. By providing tailored financing structures, private credit investors can access growth in building efficiency plays that are critical to cost reduction, while capturing attractive risk-adjusted returns in underserved markets.

Improved Resilience and Adaptation

Efficiency solutions also enhance resilience and adaptation to climate change, adding long-term value to properties. High-performance materials and modular construction improve structural durability and accelerate disaster recovery after extreme weather events. Smart systems maintain operational uptime and adaptability under stress of extreme weather, while efficient HVAC and heat-pump technologies stabilize energy demand during peak times. Collectively, these innovations help buildings, and the broader economy, adapt to increasing volatility in weather, supply chains, and energy markets.

Rising Cost of Energy

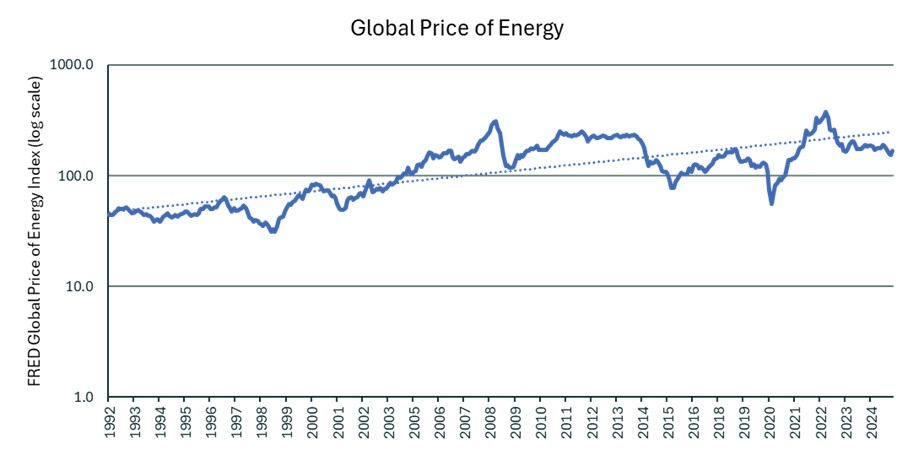

Demand for building efficiency is directly tied to energy price trends. As global energy costs rise, reducing consumption through efficient buildings becomes increasingly important. Technologies that cut heating, cooling, and electricity need help insulate owners and tenants from escalating utility bills, making efficiency investments increasingly attractive.

Global energy prices have experienced an upward trend over the past several decades. After collapsing during COVID-19, fossil fuel prices surged to historic highs in 2022, driven by post-pandemic demand and the Russia-Ukraine war. Although prices have moderated since, the IMF’s global energy price index in 2025 is still 66% higher than its 2016 baseline[iv]. Over the long term, energy costs continue to rise due to both demand growth — especially from emerging markets — and the increasing expense of extracting and delivering new supply from complex sources like deepwater fields and LNG infrastructure.

Source: Federal Reserve Economic Data, Federal Reserve Bank of St. Louis. Value represents the benchmark prices which are representative of the global market. They are determined by the largest exporter of a given commodity. Prices are period averages in nominal U.S. dollars. Logarithmic scale.

Investment Opportunities

Technological advancements offer more efficient, affordable solutions. Innovations in HVAC, smart sensors/IoT, along with advanced materials, have improved performance while reducing costs. These cost declines and efficiency gains make newer solutions economically viable at scale.

Category | 2030 Market Size & Growth Rate | Key Demand Drivers |

| High-Performance Building Materials | $1+ trillion, 12% CAGR[v] | Stricter building codes; energy savings; desire for green building certifications |

| High-Efficiency HVAC Systems | $50 billion, 9% CAGR[vi] | Aging existing HVAC systems; energy efficiency and cost savings goals; |

| Building Management Systems and Smart Building Technologies | $41 billion, 14% CAGR[vii] | Energy efficiency and cost savings goals; rise of smart IoT; tenant expectations for smart buildings |

| Modular and Prefabricated Construction | $23 billion, 8% CAGR[viii] | Need for faster, cost-effective construction; waste and cost reduction; affordable housing initiatives |

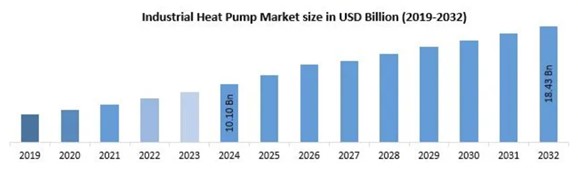

| Industrial Heat Pumps | $18 billion, 14% CAGR[ix] | Energy efficiency and cost savings; industrial decarbonization goals |

High-Performance Building Materials

High-performance building materials include advanced insulation, high-efficiency windows, cool roofing, and other envelope components that reduce heat transfer and air leakage. These solutions cut heating and cooling needs for decades after installation, enabling buildings to deliver comfort with far lower energy consumption. They are essential for achieving high-efficiency and net-zero-energy standards.

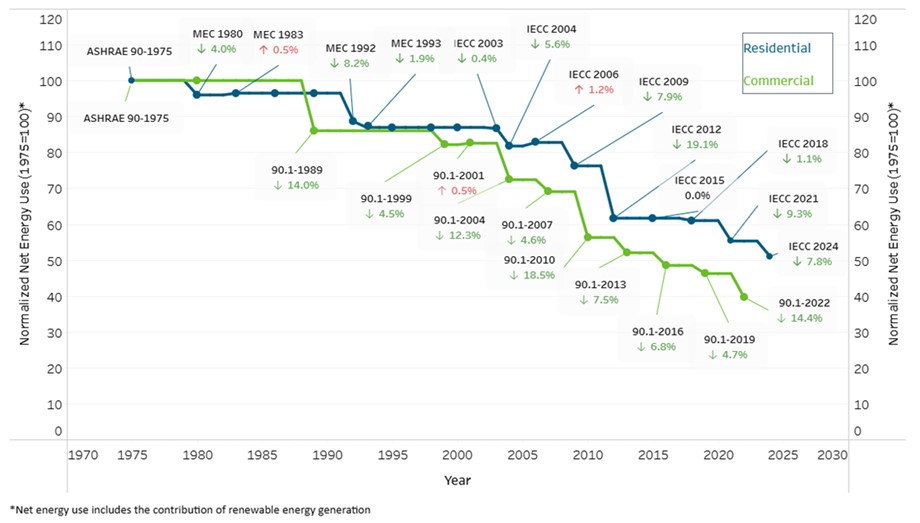

Regulation is a primary driver. Building codes worldwide continue to tighten requirements for insulation, window performance, and airtightness. For example, the latest IECC and Canada’s National Energy Code mandate significant improvements in R-values and air barriers[x]. Many jurisdictions now require high-performance materials in new construction, while retrofit programs and energy disclosure rules push upgrades in existing buildings.

Tightening Energy Codes Driving Demand for High-Efficiency Building Materials

Source: US Department of Energy.

At a $400+ billion market today and growing 12% annually toward $1+ trillion by 2030[xi], this market offers opportunities across the entire value chain—from raw materials to installation. Few sectors of this size deliver such strong growth, making it an attractive investment opportunity. For private credit, manufacturers’ capital-intensive factory expansions create financing opportunities backed by tangible assets, strong demand, and scalable projects.

High-Efficiency HVAC Systems

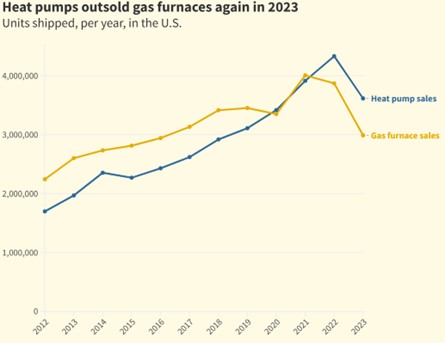

Heating and cooling systems are typically the largest energy consumers in buildings, making HVAC efficiency a critical lever for reducing energy use and costs. High-efficiency solutions—such as next-generation heat pumps, advanced electric furnaces and boilers, high-SEER air conditioners, and smart ventilation systems—can cut energy consumption by 20–50% compared to older systems[xii], delivering substantial utility savings for building owners. This category spans residential, commercial, and industrial upgrades and is central to efforts to reduce costs in the built environment, as efficient HVAC directly lowers electricity and fuel demand for indoor climate control.

The sector is experiencing strong growth driven by a shift away from traditional gas furnaces and air conditioners toward heat pump technology. More broadly, energy-efficient HVAC equipment — including advanced central AC units and variable refrigerant flow systems — is steadily gaining market share. As of 2024, efficient systems like heat pumps account for roughly 25% of HVAC installations in North America and are growing at about 5% annually in penetration[xiii]. This upward trajectory reflects improving performance, declining costs, and expanding manufacturing capacity, which is easing supply constraints and reducing unit prices.

Source: Canary Media, Air-Conditioning, Heating, and Refrigeration Institute. Units shipped are an approximation of sales.

For investors, this space offers strong fundamentals: sustained demand for energy efficiency can reduce investment risk, while the essential nature of HVAC systems ensures long-term relevance. Many HVAC equipment businesses also have robust asset bases and predictable cash flows, making them attractive candidates for private credit financing. Opportunities include funding for production expansion, equipment financing, and structured lending tied to collateralized assets—providing investors with exposure to a high-growth, energy-transition segment backed by tangible assets.

Building Management Systems and Smart Building Technologies

Building Management Systems (BMS), or Building Automation Systems, integrate control of HVAC, lighting, ventilation, security, and other systems to optimize performance and energy use. Modern platforms leverage IoT sensors, AI, and advanced software to deliver up to 30% energy savings[xiv] by reducing waste and operating systems only when needed. BMS is now the “brain” of smart buildings, standard in new construction and driving a large retrofit market as older buildings upgrade from analog to digital systems. Investment opportunities span software providers, hardware manufacturers, and integrators.

Energy efficiency and cost savings are the primary drivers of adoption and demand, with ROI often under five years[xv]. Rising energy prices and sustainability mandates make upgrades compelling. The smart building trend—enabled by IoT sensors and cloud analytics—adds predictive maintenance, real-time optimization, and enhanced tenant comfort. Occupants increasingly expect smart, sustainable spaces, pushing demand for features like individualized climate control and app-based interfaces, which can command premium rents.

The BMS sector combines tech-like growth with infrastructure-like durability, expanding at ~14% CAGR[xvi] as building digitization accelerates. SaaS models and long-term service contracts create sticky, recurring revenue streams, while integration with energy assets like solar and EV charging opens new revenue pools. Though less asset-heavy than other built environment sectors, private credit opportunities still exist in growth financing for established providers with positive and growing EBITDA and retrofit programs backed by energy savings or contracts with creditworthy building owners.

Modular and Prefabricated Construction

Modular construction fabricates building components off-site in traditional factories and assembles them on-site, dramatically improving construction efficiency, reducing waste, and often enhancing build quality and energy performance once installed. This method minimizes onsite construction waste, integrates advanced materials, and supports sustainability goals while addressing housing shortages and high labor costs through faster, more affordable delivery. The investment opportunity spans modular manufacturers, supply chains, and specialized developers as demand for efficient, cost-effective buildings grows.

Modular construction enables projects to finish 30–50% faster[xvii] than traditional builds by combining parallel site work and factory fabrication, reducing delays and costs. Controlled production improves quality, cuts waste by up to 90%[xviii], and supports green certifications. Rising labor costs and skilled trade shortages make modular’s productivity gains compelling, while precision-built modules deliver superior performance and integrate advanced materials consistently, shifting perceptions from “lower quality” to “higher performance” and fueling consumer adoption.

By applying a manufacturing model to construction of homes, modular homes offer scalability and higher margins compared to traditional contractor businesses. Leading firms benefit from strong order backlogs, providing revenue visibility and reducing credit risk. Capital-intensive factories and equipment needs create opportunities for private credit financing tied to plant expansions, production lines, and work-in-progress inventory backed by purchase contracts. Structured lending around modular’s predictable production cycle gives investors collateralized exposure to a disruptive, high-growth segment.

Industrial Heat Pumps

Industrial heat pumps extend beyond space heating to deliver efficient process heat for factories, district heating networks, and large commercial facilities. These high-capacity systems capture waste or ambient heat and raise it to higher temperatures for uses like drying, pasteurization, and chemical production—offering a sustainable alternative to fossil-fuel boilers. Given that industrial process heating is one of the hardest-to-decarbonize energy loads, heat pumps are emerging as a key technology for reducing energy use and emissions in industry.

Industrial heat pumps can cut energy consumption by 30–60% compared to conventional heating[xix] by recovering waste heat or leveraging ambient sources. This translates into major cost savings for energy-intensive sectors such as pulp and paper or food processing, where moderate-temperature waste heat can be upgraded for reuse. The combination of operational savings and sustainability compliance creates strong economic and regulatory incentives for adoption.

Source: Maximize Market Research. Industrial Heat Pump Market Size, Share, Trends and Forecast Analysis (2025-2032).

This segment represents a high-growth opportunity, with global penetration still projected at only 10–20% of industrial heating needs by 2030[xx]. Heat pumps’ favorable economics and mission-critical role in industrial processes create long-term stickiness, recurring revenue from maintenance, and high switching costs. Capital-intensive installations—often financed through energy service agreements or leases—generate predictable cash flows secured by equipment and host obligations, offering infrastructure-like downside protection and stable yields for investors. These characteristics make heat pumps highly attractive for private credit investors seeking resilient, growth-based returns.

Conclusion

The built environment is experiencing significant energy efficiency and climate resilience transformation, presenting diverse and attractive investment opportunities. The categories examined here – from efficient HVAC and heat pumps to advanced materials, prefab construction, and smart building systems – complement one another in forging a more resilient building ecosystem. They are all supported by strong macro drivers like high energy prices, urban growth, increasingly frequent extreme weather events, and aggressive climate policies, which create a favorable backdrop for sustained demand.

Sources and Endnotes

[i] U.S. Department of Energy, Energy Information Administration, available at www.eia.gov/totalenergy.

[ii] U.S. Energy Information Administration. (2021). Commercial Buildings Energy Consumption Survey (CBECS). Retrieved from https://www.eia.gov/consumption/commercial/, accessed October 5, 2025. To create a unified time series from 1992 to 2020 with RECS data, missing data points between survey years were linearly interpolated. This method estimates intermediate values based on trends observed in adjacent years. These extrapolated figures should be interpreted as estimates, not official EIA statistics. The 2025 energy expenditure figures were extrapolated using linear regression based on historical data and should be interpreted as estimates rather than official EIA statistics.

[iii] U.S. Energy Information Administration. (2021). Residential Energy Consumption Survey (RECS). Retrieved from https://www.eia.gov/consumption/residential/, accessed October 5, 2025. To create a unified time series from 1992 to 2020 with CBECS data, missing data points between survey years were linearly interpolated. This method estimates intermediate values based on trends observed in adjacent years. These extrapolated figures should be interpreted as estimates, not official EIA statistics. The 2025 energy expenditure figures were extrapolated using linear regression based on historical data and should be interpreted as estimates rather than official EIA statistics.

[iv] Federal Reserve Bank of St. Louis, Global price of Energy index, accessed August 5, 2025. https://fred.stlouisfed.org/series/PNRGINDEXM

[v] EIN News. (2025, February 28). Green Building Materials Market Size Worth USD 1,199.52 Billion by 2032 at a CAGR of 12.3%. Retrieved from https://www.einnews.com/pr_news/828022223/green-building-materials-market-size-worth-usd-1-199-52-billion-2032-a-cagr-of-12-3.

[vi] Research and Markets. (2025). North America Heat Pumps Market, By Country, Competition, Forecast and Opportunities 2020–2030. Retrieved from https://www.researchandmarkets.com/reports/6089654/north-america-heat-pumps-market-country.

[vii] GlobeNewswire. (2025, May 15). Building Management System Market Size and Share Analysis, Forecast Report 2025–2033. Retrieved from https://www.globenewswire.com/news-release/2025/05/15/3082358/0/en/Building-Management-System-Market-Size-and-Share-Analysis-Forecast-Report-2025-2033.html.

[viii] Grand View Research. (2025). North America Modular Construction Market Outlook. Retrieved from https://www.grandviewresearch.com/horizon/outlook/modular-construction-market/north-america.

[ix] 6Wresearch. (n.d.). How big is the industrial heat pump market? 6Wresearch. https://www.6wresearch.com/market-takeaways-view/how-big-is-the-industrial-heat-pump-market.

[x] International Code Council. (2024). 2024 International Energy Conservation Code (IECC). Retrieved from https://codes.iccsafe.org/content/IECC2024V1.2/index. National Research Council Canada. (2020). National Energy Code of Canada for Buildings 2020. Retrieved from https://nrc.canada.ca/en/certifications-evaluations-standards/codes-canada/codes-canada-publications/national-energy-code-canada-buildings-2020.

[xi] Fortune Business Insights. (2024, May 13). Green Building Materials Market Size, Share & Industry Analysis, 2024–2032. Retrieved from https://www.fortunebusinessinsights.com.

[xii] U.S. Department of Energy. (2023, May 30). Pump Up Your Savings with Heat Pumps. Retrieved from https://www.energy.gov/articles/pump-your-savings-heat-pumps. SolarTech Online. (2025, August 19). Most Energy Efficient HVAC Systems 2025: Complete Guide & Rankings. Retrieved from https://solartechonline.com/blog/most-energy-efficient-hvac-systems-2025/.

[xiii] Research and Markets. (2025, May 29). North America Heat Pumps Market, By Country, Competition, Forecast and Opportunities 2020–2030F. Retrieved from https://www.globenewswire.com/news-release/2025/05/29/3090529/0/en/North-America-Heat-Pumps-Analysis-Report-2025-50-Bn-Market-Trends-Country-insights-Competition-Forecast-and-Opportunities-2020-2030-Government-Incentives-and-Green-Building-Codes-L.html.

[xiv] Poyyamozhi, M., Murugesan, B., Rajamanickam, N., Shorfuzzaman, M., & Aboelmagd, Y. (2024). IoT—A Promising Solution to Energy Management in Smart Buildings: A Systematic Review, Applications, Barriers, and Future Scope. Buildings, 14(11), 3446. https://doi.org/10.3390/buildings14113446. KPMG. (2025, September 28). How AI Systems can Cut Building Energy Waste by 30%. Sustainability Magazine. Retrieved from https://sustainabilitymag.com/news/kpmg-ai-systems-can-cut-building-energy-waste-by-up-to-30.

[xv] Electrical Engineering Hub. (2024). Building Management System (BMS) Installation Cost & ROI: Pro Tips.

https://azadtechhub.com/building-management-system-bms-installation-cost-roi-pro-tips/.

[xvi] GlobeNewswire. (2025, May 15). Building Management System Market Size and Share Analysis, Forecast Report 2025–2033. Retrieved from https://www.globenewswire.com/news-release/2025/05/15/3082358/0/en/Building-Management-System-Market-Size-and-Share-Analysis-Forecast-Report-2025-2033.html.

[xvii] Modular Building Institute. (2025). What is Modular Construction – Benefits of Modular Construction. Retrieved from https://www.modular.org/what-is-modular-construction/.

[xviii] Builtfront Blog. (2025, February 2). Modular Construction in 2025: Costs, Benefits, and Why It’s the Future. Retrieved from https://builtfront.com/blog/modular-construction/.

[xix] Rightor, E., P. Scheihing, A. Hoffmeister, and R. Papar. 2022. Industrial Heat Pumps: Electrifying Industry’s Process Heat Supply. Washington, DC: American Council for an Energy Efficient Economy. aceee.org/research-report/ie2201.

[xx] Maximize Market Research. (2025). Industrial Heat Pump Market Size, Share, Trends and Forecast Analysis (2025–2032). Retrieved from https://www.maximizemarketresearch.com/market-report/industrial-heat-pump-market/184313/